Mister Worker is an Italian based retailer, therefore, all our orders are shipped from the EU.

If you require that your order is accompanied by specific documentation (e.g. certificate of origin, EUR.1, certificate of conformity, etc.), we kindly ask you to contact our sales team at sales@mrworker.com before placing your order.

European Union countries

Orders of private European customers are subject to the VAT rate of the country of destination of the goods. The VAT rate and amount will be reflected in the invoice of your order.

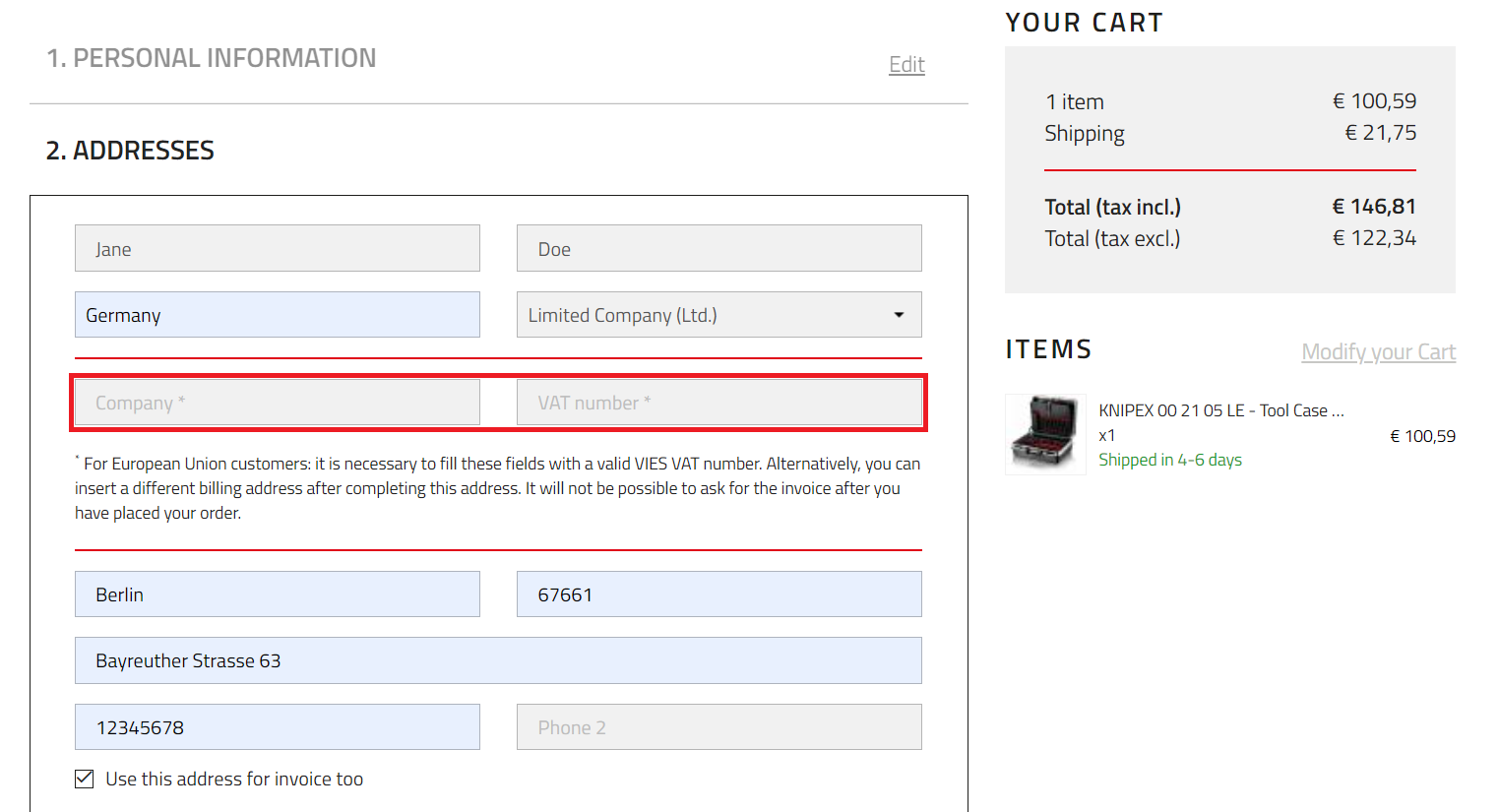

If you provide a valid EU VAT number, the invoice of your order will not be subject to VAT thanks to the intra-community agreement. You can provide your VAT number during the purchase process in the Addresses section. You can also insert a different billing address (Invoice address) after completing the delivery address. Please note that it will not be possible to provide these details after you have placed your order.

UK orders

UK orders up to £135 in value are subject to a 20% VAT fee. This VAT fee will be collected at the time of your purchase.

If you provide a valid VAT registration number, your order will not be subject to VAT.

Please keep in mind that orders shipped outside of the EU may be eligible for duties charged upon arrival in the UK. Unfortunately, we cannot predict the cost of duties/taxes. We suggest contacting your local customs office for guidance on this.

If payment of duties is refused by the customer after arriving in the UK, the parcel will be returned to us. The cost of the return will be deducted from your refund. We will also not be able to refund your outbound delivery charge.

Extra-EU orders

All the other international (Extra-EU) orders are not subject to the VAT fee. However, please keep in mind that orders shipping outside of the EU may be eligible for taxes and duties charges upon arrival in the desired country. Unfortunately, we cannot predict the cost of duties/taxes. We suggest contacting your local customs office for guidance on this.

If payment of taxes and duties payments are refused by the customer after arriving in the desired country, the parcel will be returned to us. The cost of the return will be deducted from your refund. We will also not be able to refund your outbound delivery charge.